Bank cards may be a much better individual personal loan different if you need the flexibility to attract revenue as desired, pay out it off and re-use it.

Auto insurance policy guideAuto insurance plan ratesBest vehicle insurance companiesCheapest vehicle insurancePolicies and coverageAuto insurance policies opinions

We keep a firewall concerning our advertisers and our editorial staff. Our editorial workforce will not obtain direct payment from our advertisers. Editorial Independence

The time frame till your loan achieves maturity and is particularly paid out off in completion. Terms is usually expressed in months or yrs, with regards to the specifics of your bank loan.

A private line of credit history is revolving credit, so the money is drawn and repaid like by using a charge card. Rather than a personal personal loan’s lump sum of money, a credit rating line presents usage of resources you can borrow from as necessary. You fork out interest only on Everything you borrow. Banking institutions typically offer you particular traces of credit score.

The approximated variety of charges, for a percentage of your respective complete credit card debt volume resolved, that happen to be owed for the personal debt settlement provider as payment for their expert services.

You should exploration which choices greatest fit your money problem. Evaluate the personal loans’ desire fees and terms, how long you will have to repay the quantity you borrow, and whether or not the credit card debt is secured or unsecured. You will also desire to exploration shopper assessments of various lenders. The bottom line

When it’s best: BNPL is most effective for important, one particular-time purchases you wouldn’t normally have the ability to buy with income. It might be a superb funding selection in the event you don’t Have got a credit card or have a zero-interest offer you.

Enroll and we’ll deliver you Nerdy posts with regards to the income subjects that matter most for you in addition to other methods to help you get extra from your cash.

Such loans are generally secured. If a consumer is struggling to pay back the installment amounts, the lender can seize the belongings which were employed as collateral.

Our editorial crew receives no direct payment from advertisers, and our articles is extensively fact-checked to be certain accuracy. So, whether you’re looking at an post or an assessment, you'll be able to belief that you just’re receiving credible and trustworthy info.

The federal government is Again presenting cost-free COVID take a look at kits. When it opens in September, you are able to get approximately four kits for each home at COVIDTests.gov. All at no cost.

The author's pro insights Just one other error to stop is committing to a personal personal loan Should your profits is unstable. Should you gain the majority within your earnings from variable revenue like commissions or tips, a fixed payment might be hard to manage if you have a reduced earnings month.

Thomas J. Brock is actually a CFA and CPA with greater than twenty years of knowledge in several areas including investing, insurance coverage portfolio administration, finance and accounting, personalized financial investment and financial preparing guidance, and improvement of educational supplies about Consumer Loans everyday living insurance and annuities.

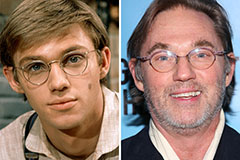

Patrick Renna Then & Now!

Patrick Renna Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now!